The VAT rate will increase from 1 January

On 1 January, 2024, the VAT rate in the Republic of Estonia will increase from the current 20% to 22%. This means that services provided in December are taxed at a 20% tax rate, while services provided in January are taxed at the new tax rate of 22%.

Due to the law, the increase in the VAT rate applies to all Itella services and thus also affects all Itella Estonia customers.

For all Smartpost private and prepaid customers’ shipments that have not been paid for as of 31.12.2023 23:59, we will add a VAT rate increase since 01.01.2024 00:00. Therefore, if you wish to pay for your delivery with the current 20% VAT, please make your payment before the new year.

Find more information on the website of the Estonian Tax and Customs Board.

More news

-

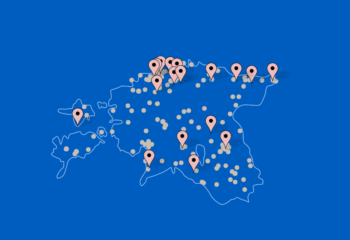

The newest locations of Smartpost in 2024

The Smartpost network has significantly expanded. We are excited to…

Read more -

End-of-Year Service Hours

Please plan your end-of-year shipments in advance, as delivery times…

Read more -

Pärnu Maxima XXX parcel locker is temporarily closed

We would like to inform you that due to renovation…

Read more -

Who buys Christmas gifts early and who at the last minute?

A survey conducted by Smartpost sheds light on the shopping…

Read more